Facebook’s cryptocurrency project Libra — and the associated impacts on banks, central banks, the global payments and trading system, and others — hinges on the widespread and global adoption of the digital currency, especially amongst young people in emerging markets.

To assess the likelihood of Libra adoption, we deploy a survey of 5000+ respondents in the U.S., India, and Nigeria, asking whether respondents are prepared to use money that has been issued by a technology company, and whether, if they own a business, they are willing to accept such money.

In order to assess the true likelihood of Libra’s success, we need to hear from those who represent the full set of potential adopters: anyone on the Web. We therefore use a survey technology that engages respondents randomly from the Web-using population. Unlike traditional survey approaches or other online survey approaches, the technology’s algorithms ensure that anyone on the Web in each country of analysis has an equal chance of being exposed to the questions. This results in a large number and share of respondents under age 35 (74 percent), those who have never taken a survey before (50 percent), and those without a bank account (41 percent). This matters, among other reasons, because Libra’s success will hinge upon its adoption by young people in emerging markets, who represent a large share of the global online population.

We find that:

- Respondents had strong opinions, and were split evenly between those that would consider using non-traditional money and those that would not. Only 1 in 5 said they need more information. This is far lower than in similar surveys using the same method, where typically about 1 in 3 don’t have an opinion.

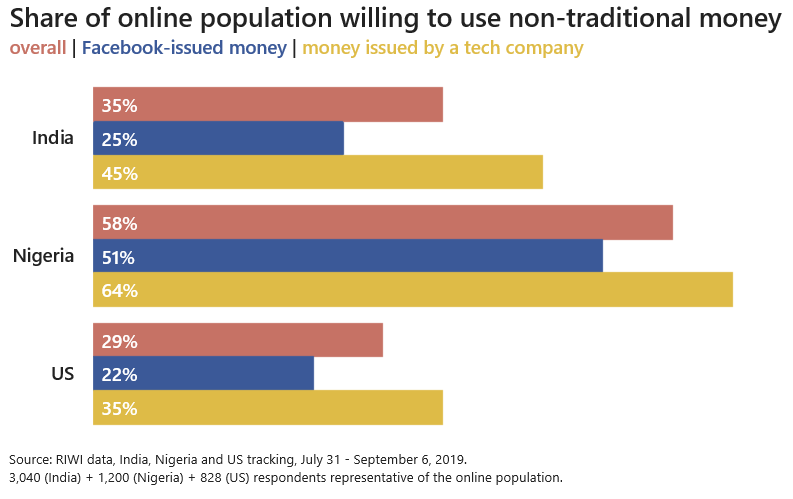

- We randomly assign half of respondents to questions about a Facebook-issued currency and the rest to a generic technology company-issued currency. Facebook has a very significant image problem, and not just in the U.S.: only changing the use of the word Facebook in the question meant 15-20 percent fewer respondents were willing to use the money.

- There is much more openness in Nigeria, and much less in the U.S. The majority (55 percent) of Nigerian respondents were willing to use non-traditional money and accept it as payment as a business (67 percent), whereas in the U.S., only 28 percent of consumers and 30 percent of businesses were willing to use or accept it.

- About 1 in 4 unbanked respondents are willing to try non-traditional money, far less than respondents with a bank account, but still notable that there is more than a marginal group of people that are open to adopting non-traditional money even without a bank account.

- We examine here only one aspect of the adoption of only one type of digital currency. Since the technology exposes questions to respondents representative of the full online population, it could be used to assess the likelihood of adoption of other digital currencies and other aspects of these currencies, as well as other financial technologies.

- These results are based on responses collected from 3,040 respondents in India, 1,200 in Nigeria, and 828 in the United States in August 2019. Surveys were translated into the dominant language in each country.

Click here to continue reading the white paper written by Dr. Andreas Park, Associate Professor of Finance at the University of Toronto, and Danielle Goldfarb, Head of Global Research at RIWI.

This report was initially published on the Rotman FinHub website.

Featured image source: Chesnot/Getty