Toronto, ON – RIWI Corp. (TSXV: RIWI) (OTC: RWCRF) (the “Company” or “RIWI”), a market research platform, global trend-tracking and prediction technology firm, reported its financial results for the quarter ended September 30, 2024. All figures are reported in U.S. dollars unless otherwise indicated. RIWI’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”).

RIWI Highlights for the three months ended September 30, 2024 – in US Dollars:

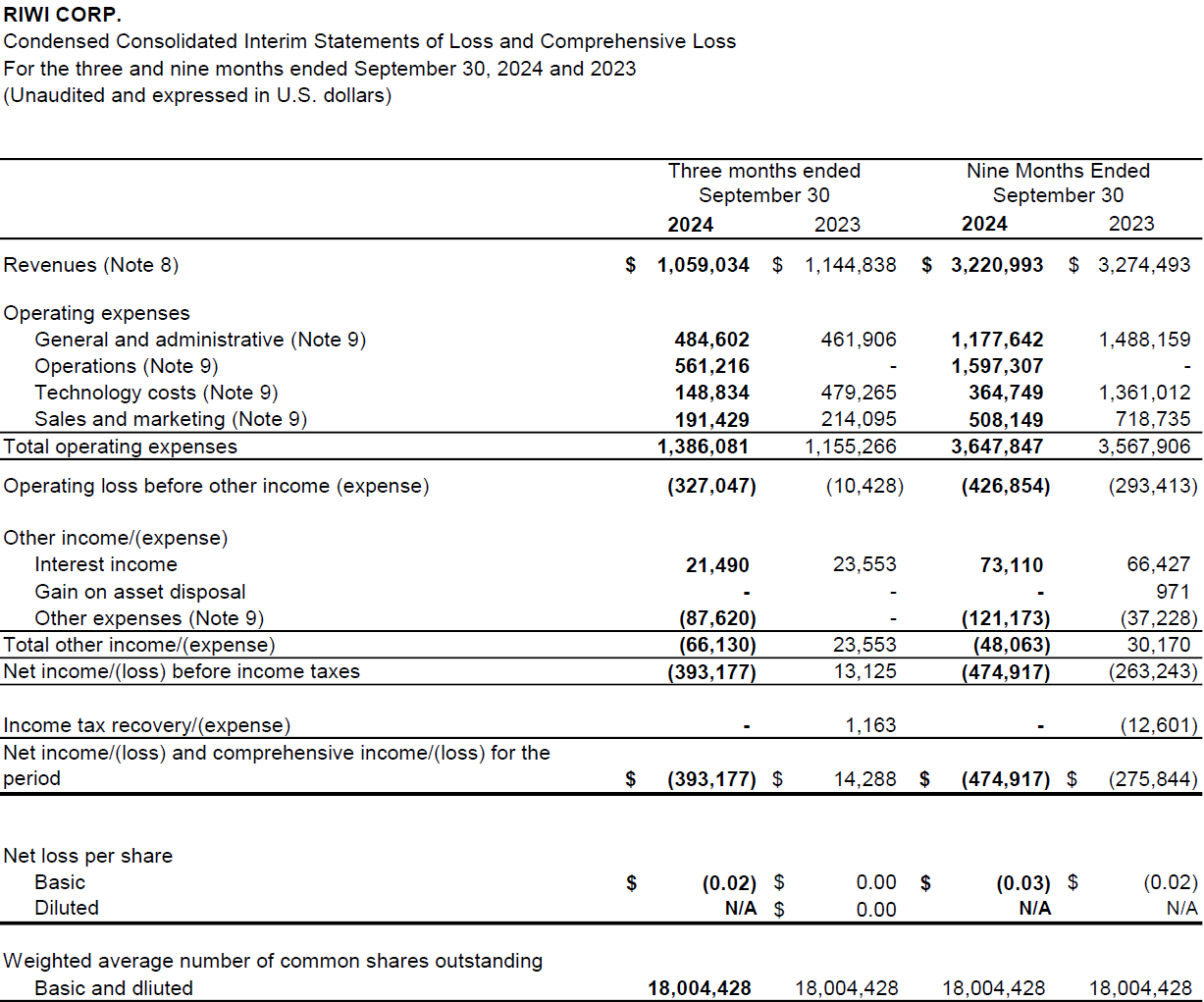

- RIWI earned $1,059,034 in revenues in the third quarter of 2024 compared to $1,144,838 for the three months ended September 30, 2023, a decrease of 7.5%. The Company’s revenue in the third quarter of 2024 consisted of $137,883 in transaction revenue, $410,999 in recurring revenue, and $510,152 in project-based revenue. RIWI also recorded a net loss of $393,177 for the period as compared to a net profit of $14,288 for the comparable period in 2023.

- On October 10, 2024, RIWI announced the acquisition of TheoremReach, Inc. (“TheoremReach”), a leading survey monetization platform. This acquisition enhances the RIWI platform by providing both an application programming interface (API) option or a self-service option for customers looking to gather rapid access to global audiences. This acquisition will increase revenue in RIWI’s transactional revenue segment. TheoremReach had approximately $3.9 million in revenue in 2023 and $433,000 of adjusted EBITDA. As noted in the management discussion and analysis (MDA) for the third quarter of 2024, management expects: (i) consolidated revenue of RIWI and TheoremReach to be between $1.9 million USD and $2.1 million USD in the fourth quarter of 2024, and (ii) management expects to achieve cost synergies of between $100,000 and $200,000 per year starting no later than the second quarter of 2025.

- As communicated in the Company’s second quarter MD&A of 2024, the RIWI transactional revenue segment was significantly impacted by RIWI’s ongoing data quality measures and the Company’s commitment to leading the sector in demonstrable high-quality data in order to win new clients in an industry increasingly sensitive to these requirements. This had a significant impact on revenue and profitability for RIWI as a whole in Q3. Although this revenue stream will continue to be impacted in the fourth quarter of 2024, management expects the negative impact seen in Q3 to be mitigated in the fourth quarter of 2024 and throughout 2025. Further, as new RIWI efficiencies to boost transactional revenue solutions accelerate — and as the TheoremReach transactional revenue solutions become integrated into RIWI’s growing offerings —, management expects the Company’s total revenues and operational profitability will steadily improve.

- RIWI signed 43 new client contracts in the three months ended September 30, 2024, including contract signings with 17 new RIWI customers.

- RIWI continued to expand its capabilities by delivering its first implicit association projects and its first central location biometric projects for customers in the packaged goods and retail clothing industries.

- RIWI exhibited at the Society of Sensory Professionals’ annual conference, showcasing the Company’s new sensory solutions including its implicit solutions tailored specifically for firms in the food and beverage, fragrance and pharmaceutical sectors.

- RIWI was recognized in several notable publications in the third quarter of 2024 including: an article in Plos One about human rights advocacy and attitudes toward gender equality in Taliban-controlled Afghanistan, an article in ScienceDirect about SMEs (Small and Medium Enterprises), violence and crisis in Latin America and referenced in UNICEFs Peacebuild framework.

“RIWI’s transformation into a leading market research and data platform company is gaining traction as can be seen by the significant improvement in our project revenues, a leading indicator into both long term repeat project business and future recurring revenue. Looking ahead, we project fourth-quarter 2024 revenues between 1.9 million and 2.1 million, representing at least 100% growth over the same period last year,” says Greg Wong, Chief Executive Officer of RIWI. “In addition, the headwinds we experienced in the third quarter of 2024 are considered either one time or temporary, leading RIWI to expect improved bottom line operating results in 2025.”

RIWI’s unaudited Financial Statements and Management’s Discussion and Analysis for the quarter ended September 30, 2024, are available via RIWI’s website at https://riwi.com and on SEDAR at www.sedar.com.

About RIWI

RIWI is a market research platform and global trend-tracking and prediction technology firm. On a monthly or annual subscription basis, RIWI offers its clients tracking surveys, continuous risk monitoring, predictive analytics and ad effectiveness tests in all countries. https://riwi.com

RIWI CORP.

Signed: “Greg Wong”

Greg Wong, Chief Executive Officer

For more information, please contact investors@riwi.com or call 1–833-FOR-RIWI (367-7494)

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION:

Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of Canadian securities legislation that involves risks and uncertainties. Forward-looking information included herein is made as of the date of this news release and RIWI does not intend, and does not assume any obligation, to update forward-looking information unless required by applicable securities laws. Forward-looking information relates to future events or future performance and reflects management of the Company’s expectations or beliefs regarding future events. This forward-looking information is based, in part, on assumptions and factors that may change or prove to be incorrect, thus causing actual results, performance or achievements to be materially different from those expressed or implied by forward-looking information.