Toronto, ON – RIWI Corp. (CSE: RIW) (OTC: RWCRF) (the “Company” or “RIWI”), a global trend-tracking and prediction technology firm, reported its financial results for the three and nine months ended September 30, 2019. All figures are reported in U.S. dollars unless otherwise indicated. RIWI’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”).

RIWI Highlights for the Third Quarter of 2019 (in U.S. Dollars)

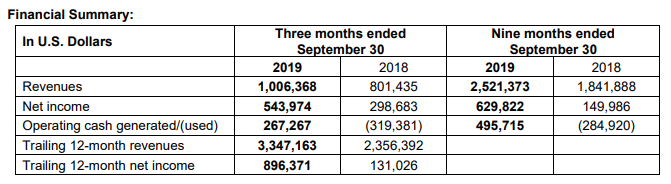

- RIWI’s third quarter of revenue was its highest in the Company’s history, surpassing the milestone of $1 million in quarterly revenue for the first time. Revenue grew by 26% to $1,006,368, compared to the three months ended September 30, 2018. For the nine months ended September 30, 2019, revenue grew by 37%, to $2,521,373, compared to the same period last year.

- The Company had a profitable third quarter, generating a net profit of $543,974, an increase of 82%, compared to the third quarter of 2018. For the nine months ended September 30, 2019, the Company generated a net profit of $629,822, an increase of 320%, compared to the same period last year.

- The Company produced $495,715 in cash from operations for the nine months ended September 30, 2019, ending the third quarter with over $2.34 million in cash.

- For the last 12 months RIWI increased:

- Revenue by 42%, reaching $3,347,163 compared to $2,356,392 for the same period last year;

- Profit by 584%, generating net income of $896,371 compared to $131,026.

- As at September 30, 2019, the Company had working capital of $3,591,259 compared to $2,349,503 as at December 31, 2018. This 53% increase results primarily from the Company’s increase in sales revenue, and from controlling costs.

- On September 27, 2019, RIWI announced that it placed Number 5 of public companies on The Globe and Mail’s ranking of Canada’s Top Growing Companies, with three-year revenue growth of 351%.

- On October 29, 2019, RIWI announced that BofA Securities (formerly, Bank of America Merrill Lynch) awarded a new contract order for $543,000 under its three-year long-term agreement. RIWI has won over $1.6 million in business with BofA Securities since the Agreement was signed in August 2017.

“I am pleased to report our growth, culminating in our first $1 million in quarterly revenue, while also increasing our profits and cash in the bank,” said Neil Seeman, RIWI’s Chief Executive Officer.

“We continue to focus on customer delivery excellence and to sharpen our sales process for more growth globally. That means serving new clients in new markets, building more market awareness for our proprietary data collection services, hiring excellent salespeople – and boosting recurring revenues and profit,” he added.

RIWI’s unaudited interim Financial Statements and Management Discussion and Analysis for the three and nine months ended September 30, 2019 and 2018, are available via RIWI’s website at https://riwi.com and on SEDAR at www.sedar.com.

About RIWI

RIWI is a global trend-tracking and prediction technology firm. On a monthly or annual subscription basis, RIWI offers its clients tracking surveys, continuous risk monitoring, predictive analytics and ad effectiveness tests in all countries – without collecting any personally identifiable data. https://riwi.com.

RIWI CORP.

Signed: “Neil Seeman”

Neil Seeman, Chief Executive Officer

For more information, please contact:

Daniel Im, Chief Financial Officer

danielim@riwi.com | +1-416-205-9984 ext. 2

CAUTION REGARDING FORWARD-LOOKING INFORMATION:

Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of Canadian securities legislation that involves risks and uncertainties. Forward-looking information included herein is made as of the date of this news release and RIWI does not intend, and does not assume any obligation, to update forward-looking information unless required by applicable securities laws. Forward-looking information relates to future events or future performance and reflects management of the Company’s expectations or beliefs regarding future events. This forward-looking information is based, in part, on assumptions and factors that may change or prove to be incorrect, thus causing actual results, performance or achievements to be materially different from those expressed or implied by forward-looking information.