RIWI employment and wage data predictive of Chinese headline PMI

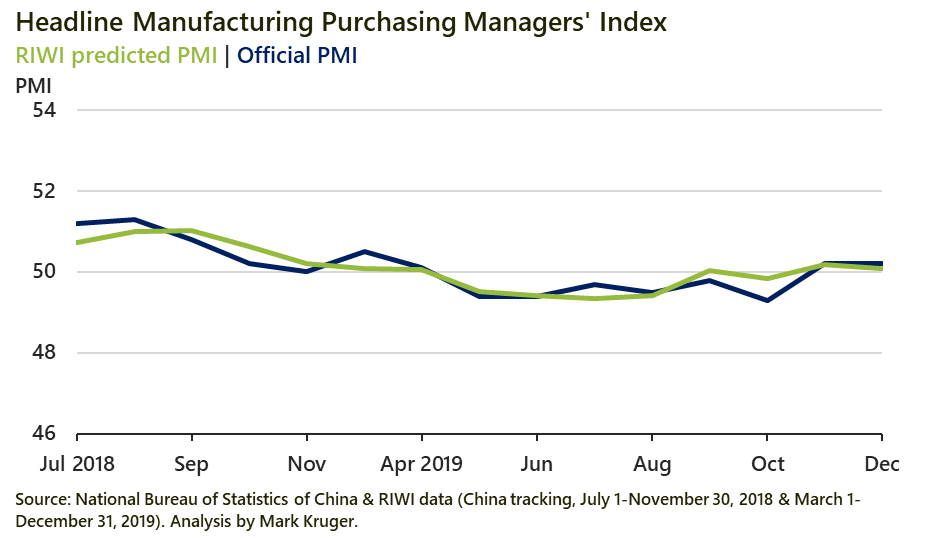

An independent assessment by former Canadian central bank economist Mark Kruger shows that RIWI employment and wage data, as reported to RIWI by randomly engaged Web users across China, are able to predict the Chinese National Bureau of Statistics’ manufacturing purchasing managers’ index (“PMI”). Moreover, the predictions based on RIWI data are more accurate than a naive random walk and Reuters’ survey of analysts. A simple model using RIWI data is also correlated at a statistically significant level with the PMI’s employment sub-indexes.

The PMI is a Chinese government survey of business conditions in the Chinese manufacturing sector that comes out ahead of official economic data. It is watched closely in financial markets as an early signal to extrapolate China’s overall growth trend. PMI is usually published several days before the official activity growth indicators (e.g. industrial production, retail sales, and fixed asset investment). It is often seen as the leading indicator on China’s overall growth.

Since all RIWI data are high-frequency, collected in near real-time, it is possible to examine these data on a daily basis, or for any time period, prior to the end of the month, instead of waiting until the end of the month when the official PMI becomes available. This analysis shows that even by the 15th of each month, the half-month RIWI model is still highly predictive (0.82 correlation; Student’s t-Test, p<.05) of the official headline PMI.

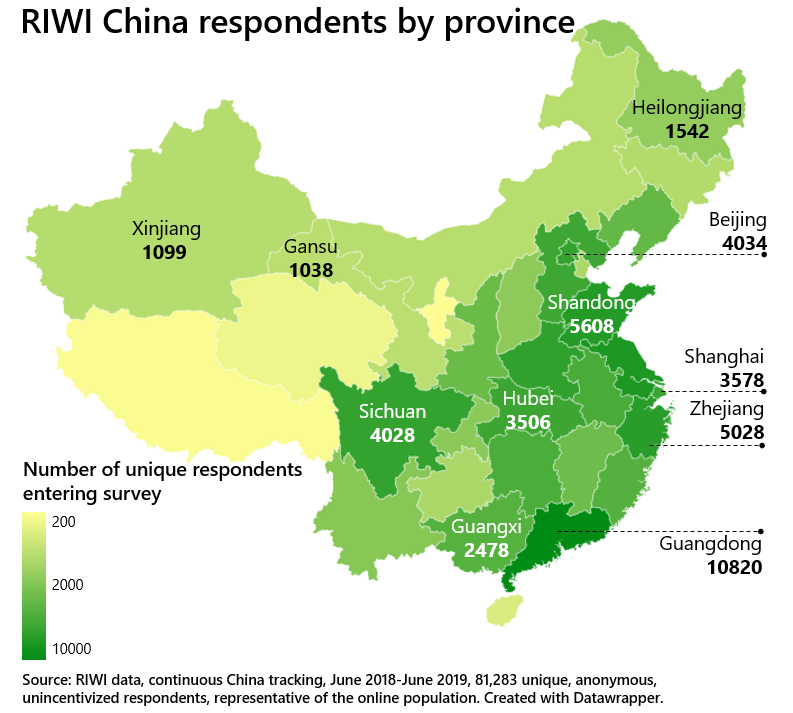

This analysis was based on broad-based sentiment data RIWI gathered on a continuous basis throughout all parts of China from June 2018-November 2018 and March 2019-December 2019.

RIWI high frequency data capture sectoral employment and other key indicators in China

The RIWI data described in this analysis also includes data on employment by sector. According to this assessment, these are otherwise unavailable data that could allow policymakers, those in business and finance, and investors to gauge the relative strength of economic activity in these sectors.

RIWI is also monitoring and validating a range of official and other economic indicators across all regions of China using its high frequency, broad-based sentiment data benchmarked against historical RIWI high frequency data. This includes travel intentions, consumer spending intentions and trends, business sentiment, and other customized indicators, at both the national and regional levels. This allows rapid assessment of system shocks including those related to the trade war and the impact of the COVID-19 Coronavirus outbreak.

RIWI collects data using patented, machine-learning technology in order to reach the broadest possible set of potential survey respondents continuously, drawing in populations otherwise not included in data collection, especially in monitored information environments. RIWI captures views of respondents representative of the Web-using population in China. RIWI’s randomized respondent-engagement approach gathers broad-based sentiment from across all of China, including urban and rural regions, and from across age groups. RIWI respondents remain anonymous and RIWI does not collect, process, store or transfer personally identifiable data, allowing respondents to provide their views freely and securely, reducing social desirability bias. RIWI respondents are not incentivized to participate in RIWI surveys in any way.

Mark Kruger is a Shanghai-based consultant on economic and financial issues related to China. He is also a Senior Fellow at both the University of Alberta’s China Institute and the Centre for International Governance Innovation. He was formerly a Senior Director in the Bank of Canada’s International Department, a Senior Advisor to the Canadian Executive Director at the International Monetary Fund, and head of the Economic and Financial Section in the Canadian Embassy in Beijing. Mark most recently co-authored Can Media and Text Analytics Provide Insights into Labour Market Conditions in China? (International Journal of Forecasting Volume 35, Issue 3, July–September 2019, Pages 1118-1130). Mark can be reached at mark@markkrugerconsultantservices.com.

Read the full analysis here, or to learn more about RIWI’s data tracking in China and all countries, please contact us at ask@riwi.com.