Will the COVID pandemic dent China’s appetite for US and global products and services? How do Chinese tourists, consumers, students feel about US/ global products and services? What sort of China does the new US administration face?

China’s economy has essentially recovered from the crisis, albeit unevenly. As a result of this fast recovery and the ongoing COVID crisis elsewhere, the country is on track to become an upper-income economy within a few years, and to overtake the US as the world’s largest economy even earlier than expected.

Will the crisis impact Chinese citizens’ appetites for global and US products and services in 2021? RIWI has been tracking a range of Chinese citizens’ perceptions and intentions on a daily basis between mid-2018 to January 2021. In contrast to other methods, these opinions are drawn randomly and anonymously from the Chinese population, and not from bots nor habitual, incentivized survey respondents. Over this period we heard from more than 180,000 unique citizens.

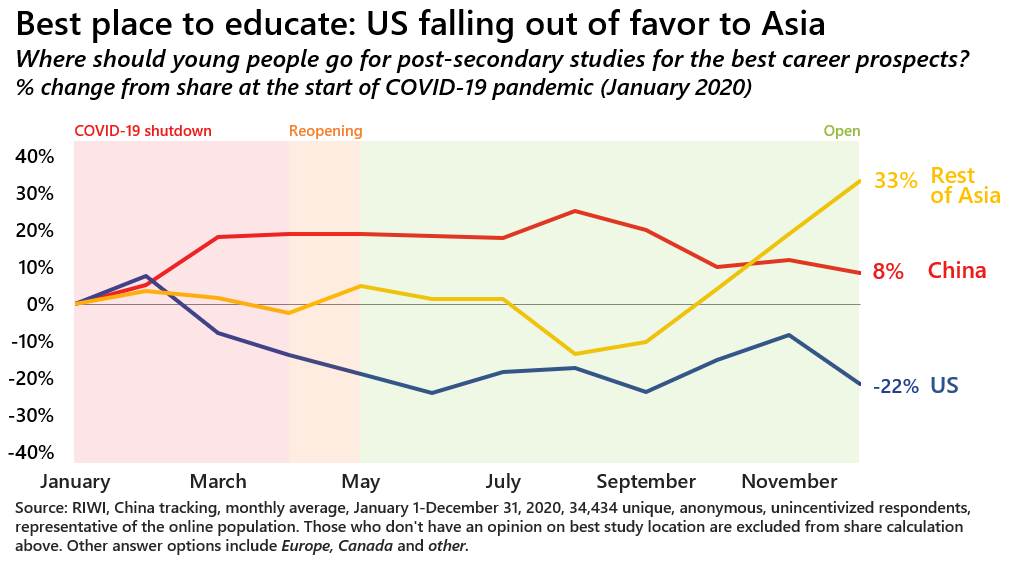

The attached deck shows some of these data points. They show that the US remained a favorable place to invest, educate, and travel during the trade war, but this favorability fell during the COVID crisis. As the crisis continues, this is changing with China and other parts of Asia becoming the main beneficiaries so far. We continue to monitor who will be the beneficiaries in the coming phases of the global crisis and recovery as some parts of the world recover from the public health crisis faster than others.

Despite a sharp deterioration in perceived US-China relations during COVID, Chinese intentions to purchase US consumer products have barely changed. This is true across a range of products, week after week, with a fresh set of respondents, across age groups and regions, and consistent across both auto-detected respondent device data as well as self-reported future intentions.

At each phase of the COVID crisis and trade war, these data allow us to continuously challenge our assumptions with evidence so we don’t mistake noise for signal.