Data current as of January 31, 2021 at 23:59 Eastern Time (ET).

- The US Bureau of Labor Statistics reported in January 2021 that December 2020 employment fell for the first time since April 2020, amid restrictions due to surging COVID-19 cases.

- A suite of RIWI real-time jobs indicators show that the jobs picture worsened further in January 2021, especially towards the end of the month.

- Each day in January 2021, we heard from a new, randomly engaged set of Americans, and each unique group of Americans confirmed this worsening trend.

- This suggests that the official employment data collected January mid-month and released February 5 are likely to undercount this deterioration. If the trend continues, we are likely to see elevated unemployment insurance claims and worsening payroll numbers in the weeks and months ahead.

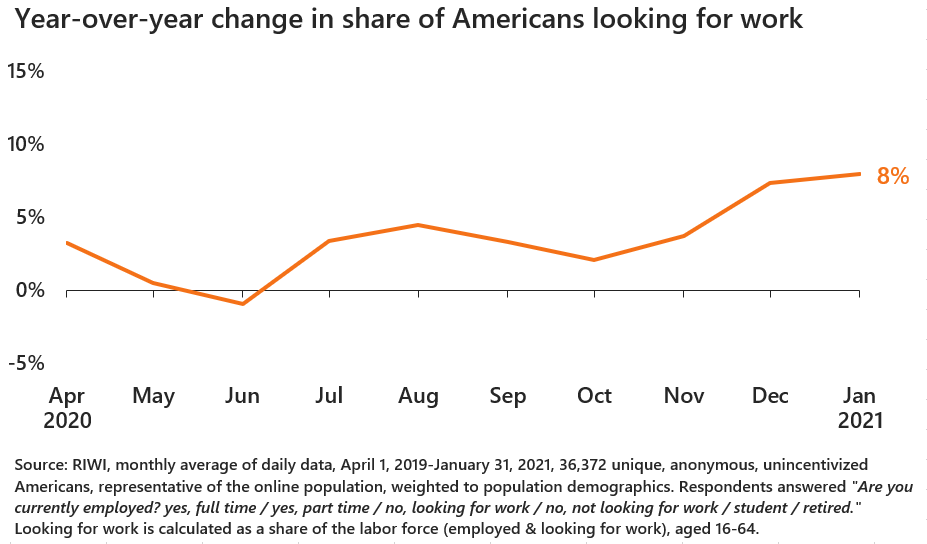

RIWI asks a unique set of randomly engaged Americans about their employment situation each day. RIWI respondents reported that a greater share of 16-64 year olds were looking for work in January 2021 relative to December 2020. The share of those looking for work in January 2021 represents an 8 point increase relative to January 2020.

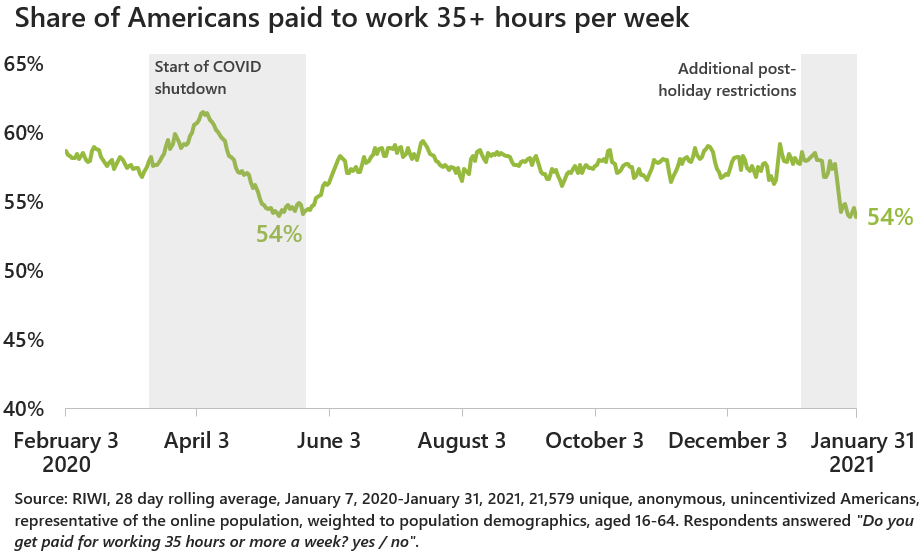

A different group of randomly engaged RIWI respondents reported a sharp decline in late January 2021 in the share of people ages 16-64 working 35 or more hours per week. This is similar to the decline during the first COVID-19 wave in the spring. (Throughout the COVID-19 crisis, the share of those aged 16-64 working 35 or more hours a week in RIWI data has largely shown a similar pattern of change to the lagging official nonfarm payroll data.)

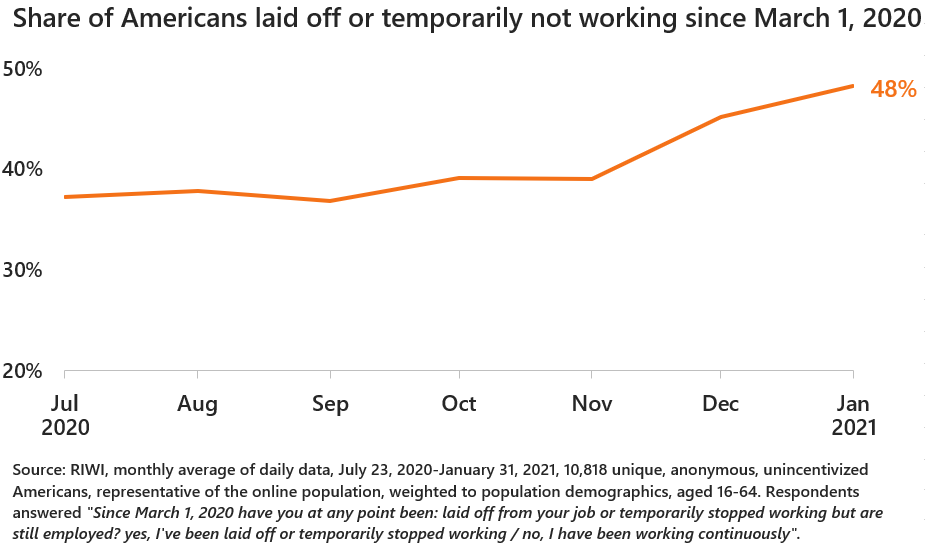

RIWI respondents also reported a notable increase in December 2020 and January 2021 in the share that had been laid off or temporarily stopped working during COVID-19, after months in which there had been little increase.

In sum, RIWI respondents are confirming a negative and further deteriorating US jobs picture in real-time. This is consistent across multiple employment-related questions. Each of these questions was asked amongst a unique set of randomly engaged Americans, and then repeated amongst a fresh, unique set of randomly engaged respondents each day, given us increased confidence in this finding.

Our daily test of these views among a new randomly engaged group of Americans will pick up, in real-time, how long this trend continues and the speed at which it improves as case counts decline and as vaccination continues.

Related RIWI research

U.S. Nonfarm Payrolls Prediction using RIWI Data

Second Wave of U.S. Layoffs and Furloughs is Well Under Way

What is the True, Real-Time U.S. Jobs Picture?

About RIWI

RIWI stands for “real-time interactive world-wide intelligence”. We provide access to continuous consumer and citizen sentiment in all countries. RIWI breaks through the noise to find the truth about what people really think, want and observe – by reaching the most diverse audiences, including the disengaged and quiet voices who do not typically answer surveys or express their views on social media. RIWI technology rapidly collects data in every country around the world and displays the results in a secure interactive dashboard in real-time. We only collect anonymous information: 229 countries and territories, over 80 languages and 1.6 billion interviewees and counting. For more information, please visit www.riwi.com.