By: Danielle Goldfarb

Decision makers around the world are increasingly preoccupied by the possibility of a significant China property market shock that could spill over and disrupt the US and global economies. A new independent analysis of RIWI real-time China housing price data shows that the underlying demand for housing remains strong and is likely to materialize again once the market stabilizes.

Because RIWI’s technology allows access to randomly engaged respondents throughout all parts of China including all city tiers, analysts can use it to gain both a broad-based perspective as well as a more granular view of Chinese housing price dynamics. RIWI has been asking a suite of economic behavior and sentiment questions in China on a continuous basis since 2018, and in January 2021 we added questions on housing price changes and affordability. Each month, we randomly engage about 2,000 unique respondents from across all cities and regions of China. Each month, we hear from a unique random cohort.

In a new piece, former central bank economist Mark Kruger has analyzed the most recent real-time RIWI data on Chinese housing prices.

“To get a more nuanced picture of the demand for upgrades, we turn to data collected by RIWI (www.riwi.com). RIWI uses patented, machine-learning technology to reach the broadest possible set of respondents. It continuously draws in populations otherwise not included in surveys. Anyone using the Web in China could be randomly exposed to a RIWI survey. The vast majority of RIWI’s Chinese respondents have never, or rarely, taken surveys before. Typically, Chinese surveys only draw on those living in key urban centres or on habitual, incentivized survey respondents. Or they use content drawn from social media. RIWI’s surveys are anonymous, continuous, random and do not collect personally identifiable information, increasing the likelihood that respondents will answer authentically.

While RIWI’s survey data do not allow us to measure “better properties” directly, they do offer strong indirect evidence that the demand for upgrades remains robust. RIWI asked its survey participants how much the price of their apartments had changed in the last 12 months.

In China, it is very easy to know the current market price of your apartment. Most urban families live in neighbourhoods made up of many, fairly similar, apartment towers. The prices of the units for sale are posted in the offices of the real estate agents, which seem to dot every street corner. Given the posted per-square-meter price of the units for sale, it is fairly easy to estimate the price of your own apartment.

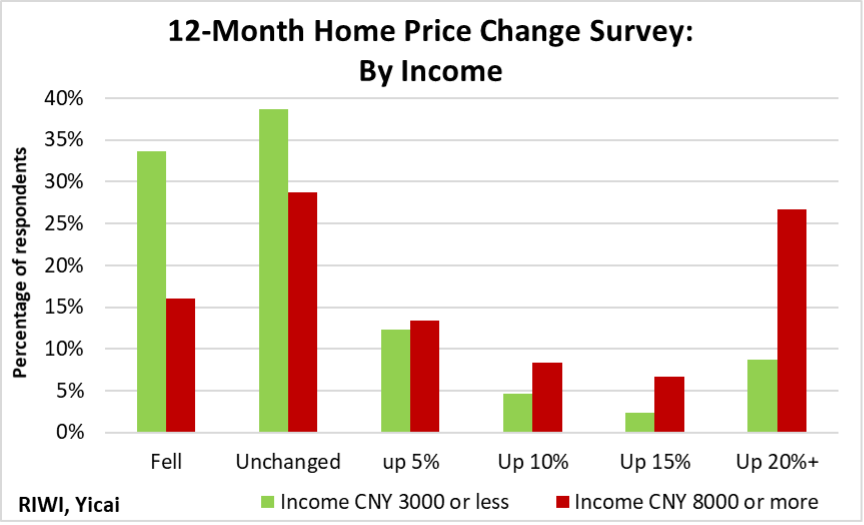

In this exercise, we look at the responses RIWI obtained for September-November. RIWI is able to sort the 12-month apartment price change by income group (see Figure). For the low-income group that earns CNY 3000 or less a month, 34 percent reported price declines, 39 percent reported unchanged prices and 28 percent reported increases.

In contrast, for the high-income group that earns CNY 8000 or more a month, only 16 percent reported declines, 29 percent reported unchanged prices and 55 percent reported increases. In fact, more than a quarter of the high-income group reported increases of 20 percent or more!

Across China’s 70 largest cities, existing home prices were only up 2.2 percent year-over-year in September-October. The much more rapid home price appreciation of those with higher incomes suggests that demand for upgrades is quite robust.

For more, see Mark’s original article “Is the Bottom Falling Out of China’s Property Market?” For Mark’s earlier article on housing prices in the first half of 2021, see “How Should We Think About Rising Home Prices?”.

Study of the RIWI China housing price dynamics data-stream is ongoing and data collection continues daily. Please be in touch with us at ask@riwi.com for more information about the data or to access/analyze the data.