Toronto, ON – RIWI Corp. (TSXV: RIWI) (OTC: RWCRF) (the “Company” or “RIWI”), a global trend-tracking and prediction technology firm, today announced that it has partnered with Macroeconomist David Woo to launch The Compass Series of Indexes – an ongoing set of indicators designed to provide actionable geo and political insights.

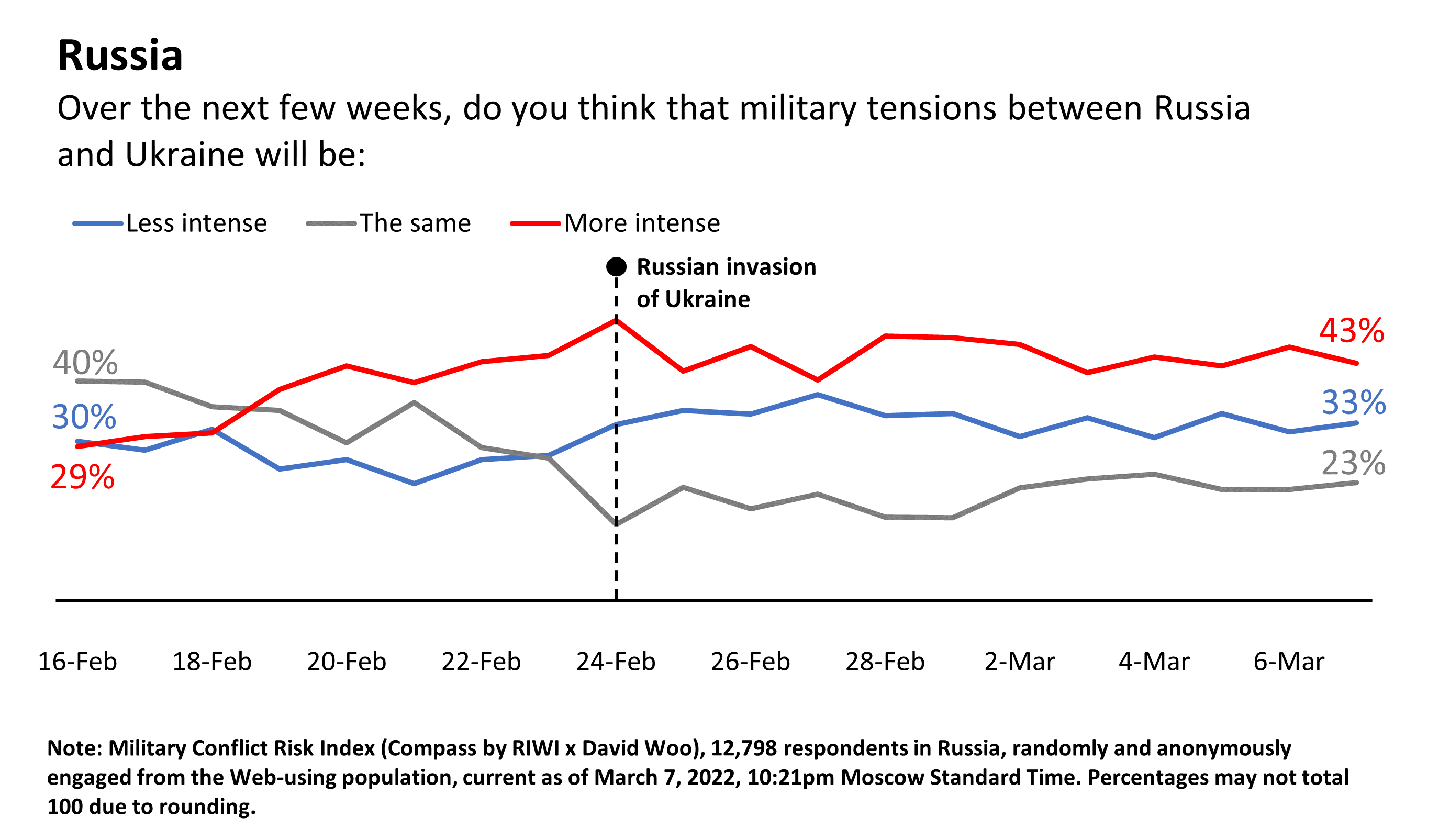

As of March 7, 10:21 p.m. Moscow time, 43 percent of those in Russia expect the Ukraine invasion to intensify, compared with 32 percent of Ukrainians, according to The Compass Military Conflict Risk Index (MCR). More respondents in Russia believe that military tensions will escalate than deescalate, and the reverse is true in Ukraine, likely reflecting the difference in perception about who has the upper hand in the conflict. Sixty-seven percent of Russians expect the conflict to intensify or stay the same, and 33 percent expect it to become less intense. This signals the risk that the conflict may worsen.

This MCR Index tracks the real-time views of citizens across five major geopolitical conflicts, including Russia and Ukraine, on whether military tensions will intensify and to determine their support for each leader’s approach to the conflict. The new Compass Series of Indexes is a joint partnership between macroeconomist and Unbound founder, David Woo and RIWI Corp., a leading provider of accurate and real-time global consumer and citizen sentiment data. As a part of this series, the latest Military Conflict Index data from March 3-7 also shows that nearly three in ten Russians strongly favor Putin’s handling of the conflict. This compares with nearly five in ten Ukrainians that strongly support Zelensky’s approach to the invasion. Despite the crackdowns on anti-war protests over the weekend, and views that the war is not going well for Putin, data from both countries have remained relatively stable from March 3-7, which could suggest that Putin is not yet under intense pressure to pull back.

To view data points from the MCR Index on the conflict click here: https://riwi.com/research/more-russians-believe-conflict-will-escalate-than-deescalate/.

The Compass Series of Indexes provides hard to reach insights that are gathered anonymously and from those that don’t typically answer opinion polls. Leveraging RIWI’s proprietary Random Domain Intercept online survey technology, The Compass Series of Indexes was established to find answers to the most important political questions of the day. By asking the right questions in a large number of countries, with the right sampling frequencies, The Compass Series of Indexes is able to produce data sets that can be analyzed systematically and in a timely manner. To learn more visit https://riwi.com/compass-series.

The first of several indexes to be released through the Compass effort include:

- Military Conflict Risk Index aims to measure, on a continuous, real-time basis, the collective perceptions of military conflict intensification from citizens in five major geopolitical conflict regions: Russia-Ukraine, China-Taiwan, Pakistan-India, South Korea-North Korea, and Iran-Israel.

- Cold War II Index captures reliable, real-time, and continuous sentiment from US, Chinese, and Russian individuals on eight of the most important economic issues of our time, including the perceived relationship between each country pair.

The Compass suite of products is unique insofar that it is specifically designed to meet the urgent need to understand the dramatic escalation of conflicts and confrontations both within and between countries. The US Capitol riots, the Canadian trucker protest, the US-China trade war, and Russia’s invasion of Ukraine are prominent examples of such conflicts. Given the massive implications of these global phenomena for political and economic stability, monitoring and predicting these trends has become imperative for policymakers, corporates, and investors alike.

“There is a great need in the market for information that helps educate and simplify complex political and economic events and for in-depth, actionable analysis, which is why I created Unbound,” said David Woo, founder of Unbound and former Head of Global Interest Rates, Foreign Exchange, Emerging Markets Fixed Income Strategy & Economics Research, Bank of America and former Head of Global Foreign Exchange Strategy, Barclays Capital, London. “This partnership with RIWI is the logical extension of Unbound whose mission is to create a global forum for honest dialogue about our shared future. Having previously collaborated with RIWI during my time at a large global bank, their ability to provide real-time accurate data is exactly what the market demands and I look forward to unearthing critical insights from often hard to reach communities via our unique Compass program.”

Speaking on The Compass Series, RIWI CEO Greg Wong shared, “RIWI is incredibly excited about the partnership with David and the launch of The Compass Series of Indexes. These Indexes provide unique insights into the macroeconomic trends between the world’s largest economies and the increasing risk and impact that conflict has on both the economy and global citizens.”

The Compass Series of Indexes were fashioned to help financial institutions, multinational corporations, international organizations, government agencies, universities, think tanks, and individual retail investors to have their fingers on the pulse on the political-economic mega trends occurring in the world today. For more information on The Compass Series, its Indexes, or to take advantage of a limited time subscription pricing discount of 20% during March, visit https://riwi.com/compass-series/.

About Unbound:

Unbound is a global forum devoted to the promotion of fact-based debates about markets, politics, and economics. Created by renowned macroeconomist and former Wall Street strategist David Woo, Unbound takes on groupthink, propaganda and conspiracy theories through a critical analysis of markets, economics, and politics. Known for his contrarian calls on pivotal global events, Woo recently served as Head of Global Rates, Foreign Exchange, Emerging Market Fixed Income & Economics Research at Bank of America, where he managed the top ranked global macro strategy team on Wall Street. He was previously the head of Global Foreign Exchange Strategy at Barclays Capital and the Head of Local Markets Strategy for Central and Eastern Europe, Middle East and Africa at Citigroup. Woo started his career as an Economist at the International Monetary Fund and completed his Ph.D in Economics from Columbia University. Woo was voted one of the twelve smartest people on Wall Street in 2013 by Business Insider. To learn more visit https://www.davidwoounbound.com or follow him on LinkedIn or Twitter @Davidwoounbound

About RIWI

RIWI is a global trend-tracking and prediction technology firm. On a monthly or annual subscription basis, RIWI offers its clients tracking surveys, continuous risk monitoring, predictive analytics and ad effectiveness tests in all countries – without collecting any personally identifiable data. https://riwi.com

RIWI CORP.

Signed: “Greg Wong”

Greg Wong, Chief Executive Officer

For more information, please contact :

Chris McCoin or Rick Smith

McCoin & Smith Communications, Inc.

chris@mccoinsmith.com or rick@mccoinsmith.com

+1 (508) 429-5988 (Chris) or +1 (978) 433-3304 (Rick)

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION:

Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of Canadian securities legislation that involves risks and uncertainties. Forward-looking information included herein is made as of the date of this news release and RIWI does not intend, and does not assume any obligation, to update forward-looking information unless required by applicable securities laws. Forward-looking information relates to future events or future performance and reflects management of the Company’s expectations or beliefs regarding future events. This forward-looking information is based, in part, on assumptions and factors that may change or prove to be incorrect, thus causing actual results, performance or achievements to be materially different from those expressed or implied by forward-looking information.