By Danielle Goldfarb and Emily Kuzan

Data current as of May 21, 2020 at 14:00 Eastern Daylight Time (EDT).

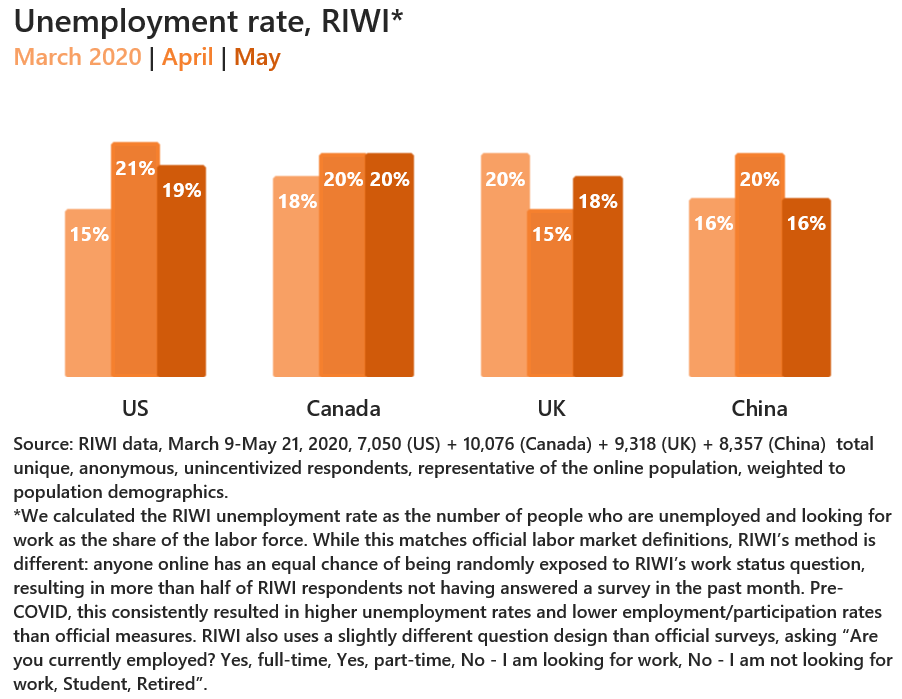

RIWI data show that just under 1 in 5 North Americans who want jobs in May don’t have them, but there are early signs of improvement as economies reopen. In China, at a more advanced stage of reopening, the impact on jobs and incomes is much more severe than official data show, as RIWI data from rural areas suggest that previously employed migrant workers (that are not captured in official data) returned home.

We are heading into economic reopening across many parts of the world. But the latest official US and Canadian jobs data are now weeks out of date, reflecting what happened in mid-April during the economic shutdown period. In the case of the UK, the latest jobs data are from March, lagging reality by months. And in the case of China, the official unemployment figures not only lag reality, but are widely believed to be unreliable in pre-COVID times, and during COVID to under-report the true extent of the economic crisis.

What does the jobs picture look like now as China continues its reopening period and other parts of the world start to enter theirs? A current picture is critical in the next days and weeks to get a sense of the true extent and pace of recovery. At RIWI, we ask randomly engaged citizens in many countries around the world about their working status on a continuous basis every day. During the crisis period, we have also been asking about changes to their income sources due to COVID. Each day, RIWI asks a new set of randomly engaged citizens. During the critical opening phases, we plan to share regular updates on employment in the US, UK, Canada, and China.

| May 2020 unemployment rate and income loss (RIWI May 1-21, 2020 data) | ||||

| US | Canada | UK | China | |

| Lost half or more of their income due to COVID (%) | 30 | 40 | 23 | 44 |

| Unemployment rate1 (%) | 19 | 20 | 18 | 16 (31 in rural areas) |

| Unemployment rate, 25-34 (%) | 23 | 23 | 15 | 13 |

| Official unemployment rate (%) [latest survey reference period] |

15 [April 12-18, 2020] |

13 [April 12-18, 2020] |

4 [March 2020] |

6 [April 2020] |

| Source: Latest official labor market statistics; RIWI data (May 1-21, 2020, 1,311 (US) + 2,903 (Canada) + 3,391 (UK) + 1,150 (China) unique, anonymous, unincentivized respondents aged 15+, randomly engaged from the online population, weighted to general population demographics). | ||||

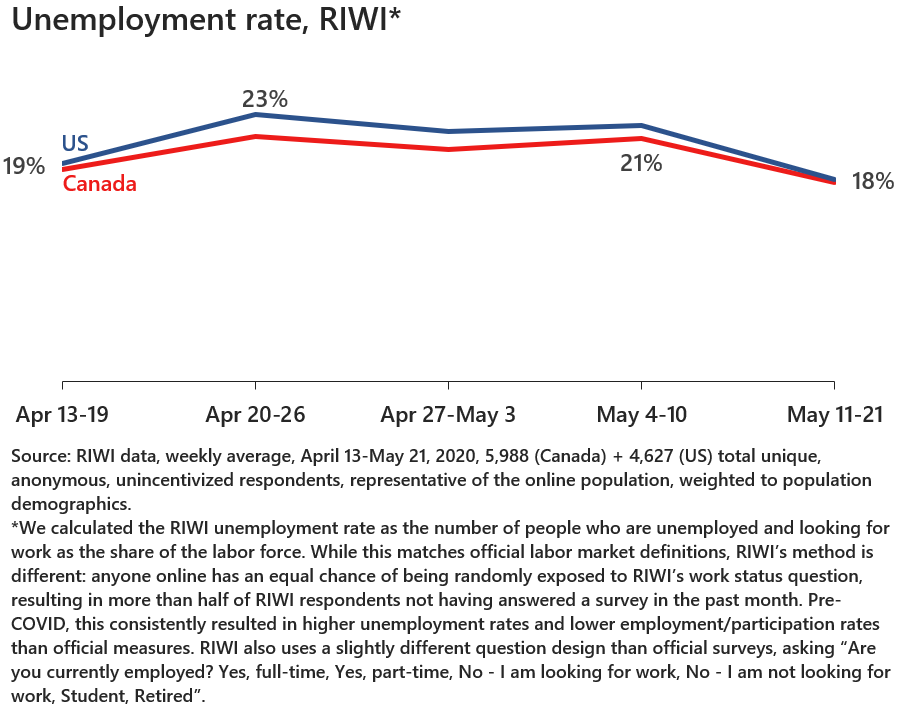

Conditions started to improve a bit in Canada by mid-May, as the unemployment rate went down from 21 percent in the week of May 4 to 17 percent from May 11-21 (see chart below), and full-time employment grew from 53 percent to 59 percent over that same period, signifying both a fall in unemployment and a return to work for those who previously had their hours reduced. The US data also show things starting to improve: US unemployment fell to 19 percent in May compared with 21 percent in April, and US full-time employment increased from 55 percent at the start of May to 60 percent by mid-May. Chinese citizens, several months ahead of the rest of the world on the reopening front, report more significant income losses and employment levels have yet to rebound, a possible harbinger for the rest of the world.

Official data will tell us what happened in the North American reopening period of May and June only in July. RIWI continues to collect data throughout May and June (and beyond) to allow leaders to keep a close, daily watch of the pace and extent of recovery.

Related research:

COVID-19’s Income Truth: Real-time losses are worse than they appear

What’s missing in job number headlines

A different type of crisis demands a different type of data

Previous RIWI jobs and income data have been widely cited during this crisis, including in these recent academic papers on US and UK Labour Markets Before and During the COVID-19 Crash and Real Time Labor Market Estimates During the 2020 Coronavirus Outbreak.

For more information on this data set, please contact Danielle Goldfarb, Head of Global Research at daniellegoldfarb@riwi.com.

RIWI’s origins are in pandemic surveillance infodemiology during H1N1 and we are actively monitoring various aspects of the COVID-19 pandemic in multiple countries. This includes tracking the trajectory of self-reported illness and testing, trust in public officials and compliance with public health directives, and the psychological, financial, and consumer impacts.

To gather these job and income status data, RIWI drew randomly from the entire Web-using population in each of Canada, the US, UK, and China. The result of this random engagement approach is that more than half of RIWI respondents in the US, UK, and Canada have not answered a survey in the past month, and more than 60 percent in China have never answered a survey before. Data collection took place continuously, allowing us to observe what happened at the start of lockdown and now as we enter early phases of reopening. All of the data were collected anonymously and respondents were not incentivized.

About RIWI

RIWI stands for “real-time interactive world-wide intelligence”. We provide access to continuous consumer and citizen sentiment in all countries. RIWI breaks through the noise to find the truth about what people really think, want and observe – by reaching the most diverse audiences, including the disengaged and quiet voices who do not typically answer surveys or express their views on social media. RIWI technology rapidly collects data in every country around the world and displays the results in a secure interactive dashboard in real-time. We only collect anonymous information: 229 countries and territories, over 80 languages and 1.6 billion interviewees and counting.

- We calculated the RIWI unemployment rate as the number of people who are unemployed and looking for work as the share of the labor force. While this matches official labor market definitions, RIWI’s method is different: anyone online has an equal chance of being randomly exposed to RIWI’s work status question, resulting in more than half of RIWI respondents not having answered a survey in the past month. Pre-COVID, this consistently resulted in higher unemployment rates and lower employment/participation rates than official measures. RIWI also uses a slightly different question design than official surveys, asking “Are you currently employed? Yes, full-time, Yes, part-time, No – I am looking for work, No – I am not looking for work, Student, Retired”.