-

Can domestic luxury electric vehicle brands compete with Tesla in China? As China’s NIO ramps up its sales, will Tesla lose market share? There is a lot of speculation but little reliable data on the true views of Chinese consumers.

-

We used RIWI technology to reach out to the broadest possible array of Chinese consumers across all cities and regions of the country. We engaged a unique random cohort every day from January 20-April 19, 2021 and asked which brand of electric vehicle they would get if they were to purchase an electric vehicle now. We focused on Tesla’s Chinese luxury competitors listed on US stock exchanges.

-

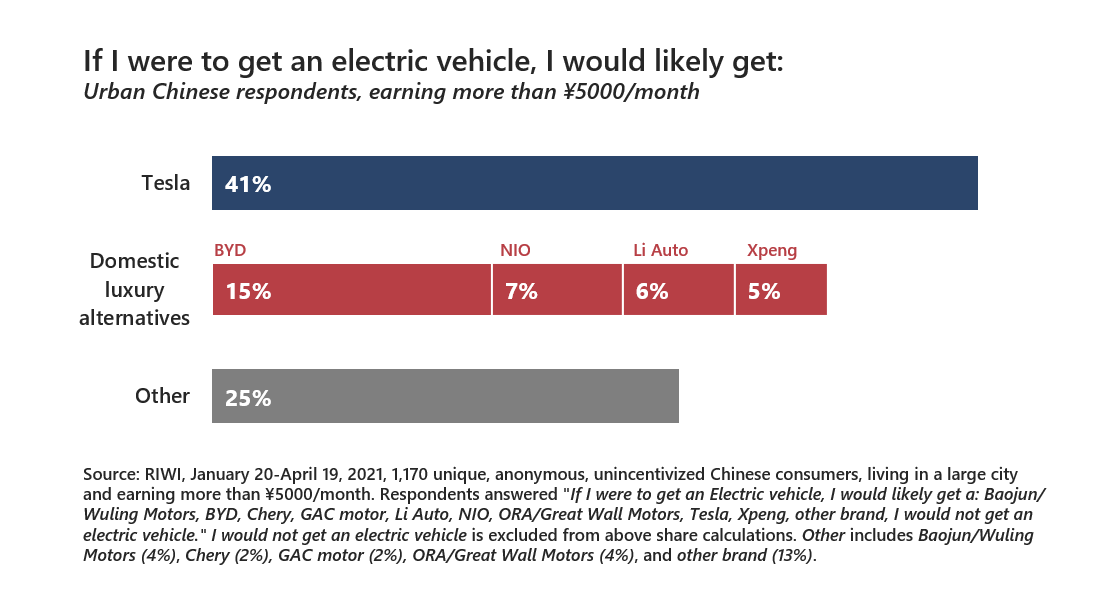

RIWI’s real-time data show that Tesla’s Chinese competitors are far behind in capturing the mindshare of the world’s largest electric vehicles market. Regardless of the unique random cohort of people asked each day from January 20-April 19, 2021, Chinese consumers consistently prefer Tesla over the other domestic electric vehicle brands. Among those living in a large city and making more than ¥5000/month, Tesla’s mindshare is higher than the cumulative mindshare of its Chinese competitors (BYD, NIO, Li Auto, and Xpeng).

-

We continue to monitor these views on a daily basis to see if they shift as the competitive landscape changes.

Tesla opened its Shanghai Gigafactory in January 2020 and began delivering China-made Teslas the following month. In 2020, Tesla doubled its China sales over the preceding year and even outperformed market estimates for first quarter sales in 2021 after releasing the Model Y in January. But government regulations and subsidies encouraging the purchase of New Electric Vehicles (NEVs) has Tesla facing increasing competition. Chinese electric vehicle startups NIO, Li Auto and Xpeng also reported surges in deliveries and stock prices in 2020. Can Chinese luxury electric vehicle brands compete with Tesla? As these competitors increase their own production and develop their technologies, will Tesla lose market share?

To get a reliable, generalizable view on sentiment, we have been using RIWI technology to hear from successive random cohorts of the Chinese Web-using population on a continuous basis from January 20-April 19, 2021 (and ongoing) for a total of 1,170 randomly engaged Web users. We asked respondents “If I were to get an Electric vehicle, I would likely get a: Baojun/Wuling Motors, BYD, Chery, GAC motor, Li Auto, NIO, ORA/Great Wall Motors, Tesla, Xpeng, other brand, I would not get an electric vehicle.”

We use this question to calculate Tesla’s mindshare among potential consumers (those living in a large city and making more than ¥5000/month) compared to other Chinese luxury electric vehicle brands. Mindshare describes consumer awareness of a brand. To calculate mindshare we exclude respondents who are not interested in purchasing an electric vehicle. And as we are only focused on Tesla’s Chinese luxury competitors listed on US stock exchanges here, we group all brands except Tesla, BYD, NIO, Li Auto, and Xpeng under “other brand”. Tesla competes in the Chinese market with other foreign automotive companies (e.g. BMW, Ford, etc.) which would fall under the “other brand” category.

We’re gathering these data using RIWI’s Random Domain Intercept Technology. Typical Web surveys in China do not recruit panelists randomly or anonymously. The result of RIWI’s random, anonymous engagement approach is that more than three in five RIWI respondents in China self-report that they have never answered a survey.

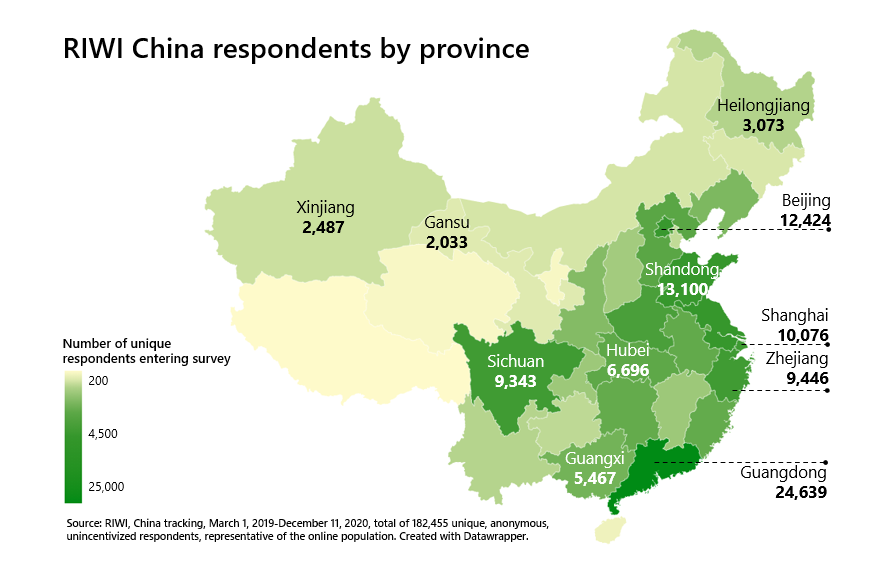

This RIWI random engagement approach also results in data from across all regions of the country and for all cities. China has 613 cities, with the wealthiest and most populous in Tier 1. There are 5 Tier 1 cities, 30 Tier 2 cities, 138 Tier 3 cities, and 480 Tier 4 cities. Most typical survey data in China does not cover Tier 3 and 4 cities.

We do not collect any personally identifiable information from respondents to maximize the chances they reply honestly. Typical surveys in China include information linking the respondent’s personal identifiers to their responses. This could mean that respondents may be less inclined to share their authentic views on domestic versus foreign brands.

RIWI data show that Tesla currently dominates its competitors in mindshare. For those living in a large city and making more than ¥5000 per month, 41 percent prefer Tesla over any other brand. This is greater than the cumulative mindshare of Tesla’s Chinese luxury electric vehicle competitors BYD (15%), NIO (7%), Li Auto (6%) and Xpeng (5%). These data suggest that Tesla remains the first electric vehicle brand that comes to mind among Chinese consumers and that Chinese competition is not likely to hinder Tesla’s near-term sales (although production bottlenecks could).

RIWI respondents confirm, day after day, Tesla’s strong mindshare in China. Maintaining this is vital for Tesla’s future China sales. As Tesla ramps up production at its Shanghai Gigafactory, we will continue to monitor to see if this mindshare indicator changes.

This piece is part two of a two-part series about Tesla in China. Part one looks at consumer sentiment towards Tesla since 2019. To learn more about these data or other RIWI data on the electric vehicle market in China, please contact Danielle Goldfarb.

RIWI captures anonymous, broad-based sentiment from across all of China

RIWI collects data using patented, machine-learning technology in order to reach the broadest possible set of potential survey respondents continuously, drawing in populations otherwise not included in data collection, especially in monitored information environments. In China, anyone using the Web could be randomly exposed to a RIWI survey, resulting in the vast majority of RIWI’s Chinese respondents never or rarely taking prior surveys. This is unlike typical surveys in China that draw only on key urban centres and on habitual, incentivized survey respondents – or on content residing on censored social media. Unlike typical episodic non-random panel-based surveys, RIWI surveys are anonymous, continuous, random and do not collect personally identifiable information. These RIWI measures increase the likelihood that respondents will answer in an authentic manner.

Between June 2018 and April 2021, we used RIWI technology to randomly engage respondents from China’s Web-using population to answer questions about their economic and consumer behaviors and attitudes. The resulting data are high-frequency in nature, gathered 24/7 and on a continuous basis. The RIWI data come from across all regions of China, and all cities. RIWI respondents are un-incentivized, meaning that they answer because the questions seem interesting; they do not benefit in any way by responding.

RIWI is a global trend-tracking and prediction company, and a leader in data quality, privacy, and security. RIWI technology is used extensively and under long-term agreements by BofA Securities, the U.S. State Department and by other G7 government agencies, the World Bank, UN agencies, and by academics at top Universities such as Harvard and Oxford. RIWI has won several awards for its global trend-tracking and predictive analytics technology, including the “Rising Star” award for its China data at the 2019 Battle of the Quants in New York City. Independent validation shows that RIWI data are highly predictive of headline economic indicators such as US non-farm payroll surprises.