-

There is a lot of hype around Tesla’s potential in China’s electric vehicle market. But there are no reliable data on whether this reflects true consumer sentiment. Analysts (for example, here) are concerned that Tesla may not be able to maintain its market share in China.

-

We used RIWI technology to reach out to the broadest possible array of Chinese consumers across all cities and regions of the country. We engaged a unique random cohort every day for almost 2 years and asked for their views on Tesla.

-

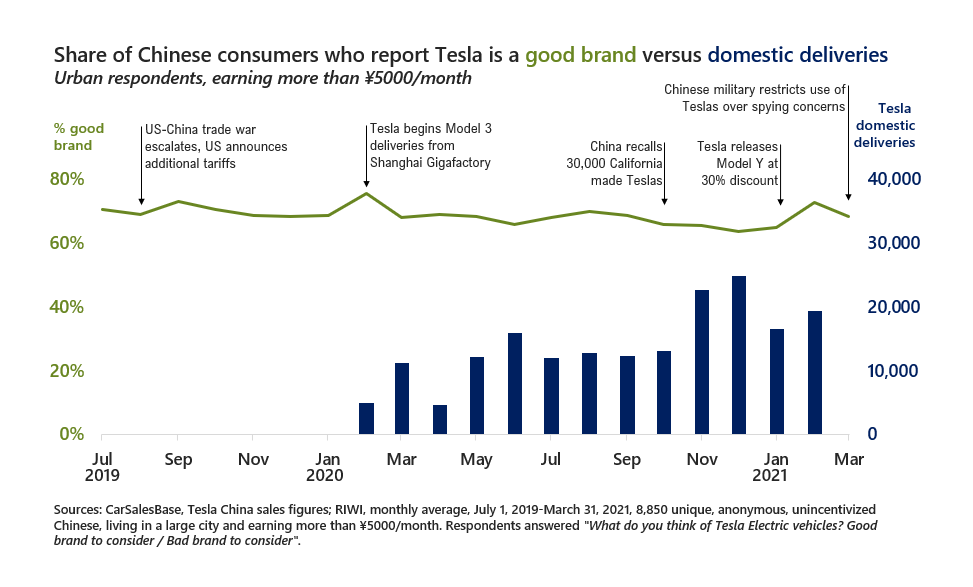

RIWI data show consistent positive brand perception among those more likely to buy Tesla (those living in a large city and making more than ¥5000/month). This wavered little despite quality and security concerns raised about Tesla’s vehicles in China, and despite deterioration in the Sino-American relationship. We continue to monitor if this changes with new events.

-

Our next piece looks at Tesla’s mindshare in China compared to Chinese luxury electric vehicle competitors.

China is the largest and fastest-growing market for electric vehicles globally. There is considerable hype surrounding Tesla and its potential in China. In 2020, Tesla made $6.6 billion USD in sales in China, doubling its 2019 figures, and its stock rose by 740 percent. Tesla outperformed market estimates for first quarter sales in 2021, with analysts citing strong performance in China as a driver of bullish momentum on the company’s stock price. Wedbush Securities estimates that China could account for 40 percent of Tesla’s global deliveries by 2022.

Despite this hype, to our knowledge there are no reliable data on what Chinese consumers actually think about the brand. Do Chinese consumers hold the same regard for Tesla as foreign investors? Does the hype reflect reality or is it noise? As quality issues and spying accusations arise, and China-U.S. tensions escalate, does this sentiment change? In March 2021, China’s government banned members of the military from driving Teslas to sensitive agencies over concerns over the cars’ cameras and sensor capabilities. Did this have an impact on Chinese consumers’ perception of the brand?

To get a reliable, generalizable view on sentiment, we have been using RIWI technology to hear from successive random cohorts of the Chinese Web-using population on their perception of Tesla’s vehicles for almost two years. We’re gathering these data using RIWI’s Random Domain Intercept Technology. Typical surveys in China do not recruit panelists randomly or anonymously. The result of RIWI’s random, anonymous engagement approach is that more than three in five RIWI respondents in China self-report that they have never answered a survey.

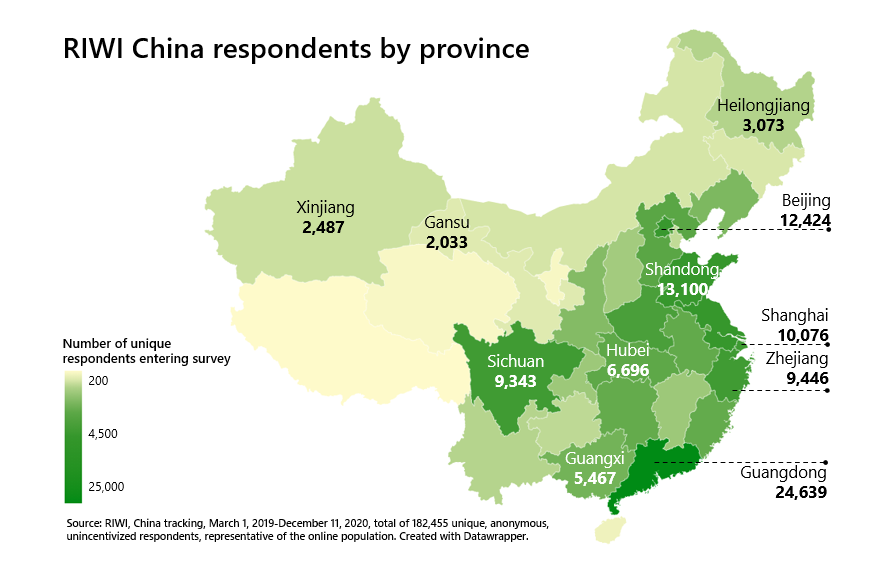

This random engagement approach also results in data from across all regions of the country and for all cities. China has 613 cities, with the wealthiest and most populous in Tier 1. There are 5 Tier 1 cities, 30 Tier 2 cities, 138 Tier 3 cities, and 480 Tier 4 cities. Most typical survey data in China does not cover Tier 3 and 4 cities.

We do not collect any personally identifiable information from respondents to maximize the chances they reply honestly. Typical surveys in China include information linking the respondent’s personal identifiers to their responses. This could mean that respondents may be less inclined to share their authentic views on domestic versus foreign brands.

We heard from respondents on a continuous basis from July 2019-March 2021 (and ongoing) for a total of 8,850 randomly engaged Web users. We asked them “What do you think of Tesla Electric vehicles? Good brand to consider / Bad brand to consider”. RIWI data show that, day after day for almost two years, among urban consumers earning over ¥5000/month, more than two in three consistently think Tesla is a good brand. We find that these positive perceptions were not impacted significantly by various quality issues, spying concerns raised by the Chinese military and increasingly tense China-U.S. relations.

RIWI respondents confirm, day after day, Tesla’s positive brand image in China. Maintaining this positive image is vital for Tesla’s future China sales. If quality and reliability concerns arise, and if tensions between the US and China continue to increase and intensify nationalist sentiment, consumers may be encouraged to turn to domestic alternatives. As Tesla ramps up production at its Shanghai Gigafactory, we will continue to monitor to see if Tesla’s brand sentiment changes.

This piece is part one of a two-part series about Tesla in China. Part two looks at Tesla’s mindshare compared to its domestic luxury electric vehicle competitors. To learn more about these data or other RIWI data on the electric vehicle market in China, please contact Danielle Goldfarb.

RIWI captures anonymous, broad-based sentiment from across all of China

RIWI collects data using patented, machine-learning technology in order to reach the broadest possible set of potential survey respondents continuously, drawing in populations otherwise not included in data collection, especially in monitored information environments. In China, anyone using the Web could be randomly exposed to a RIWI survey, resulting in the vast majority of RIWI’s Chinese respondents never or rarely taking prior surveys. This is unlike typical surveys in China that draw only on key urban centres and on habitual, incentivized survey respondents – or on content residing on censored social media. Unlike typical episodic non-random panel-based surveys, RIWI surveys are anonymous, continuous, random and do not collect personally identifiable information. These RIWI measures increase the likelihood that respondents will answer in an authentic manner.

Between June 2018 and March 2021, we used RIWI technology to randomly engage respondents from China’s Web-using population to answer questions about their economic and consumer behaviors and attitudes. The resulting data are high-frequency in nature, gathered 24/7 and on a continuous basis. The RIWI data come from across all regions of China, and all cities. RIWI respondents are un-incentivized, meaning that they answer because the questions seem interesting; they do not benefit in any way by responding.

RIWI is a global trend-tracking and prediction company, and a leader in data quality, privacy, and security. RIWI technology is used extensively and under long-term agreements by BofA Securities, the U.S. State Department and by other G7 government agencies, the World Bank, UN agencies, and by academics at top Universities such as Harvard and Oxford. RIWI has won several awards for its global trend-tracking and predictive analytics technology, including the “Rising Star” award for its China data at the 2019 Battle of the Quants in New York City. Independent validation shows that RIWI data are highly predictive of headline economic indicators such as US non-farm payroll surprises.