By: Danielle Goldfarb, Emily Kuzan, and Jason Cho

Data are current as of February 11 at 23:59 China Standard Time (GMT +8).

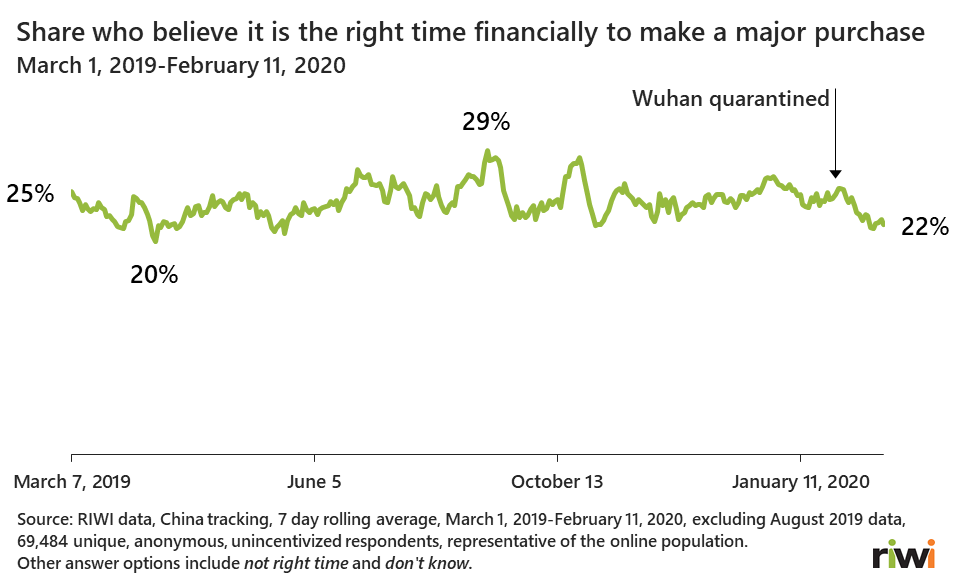

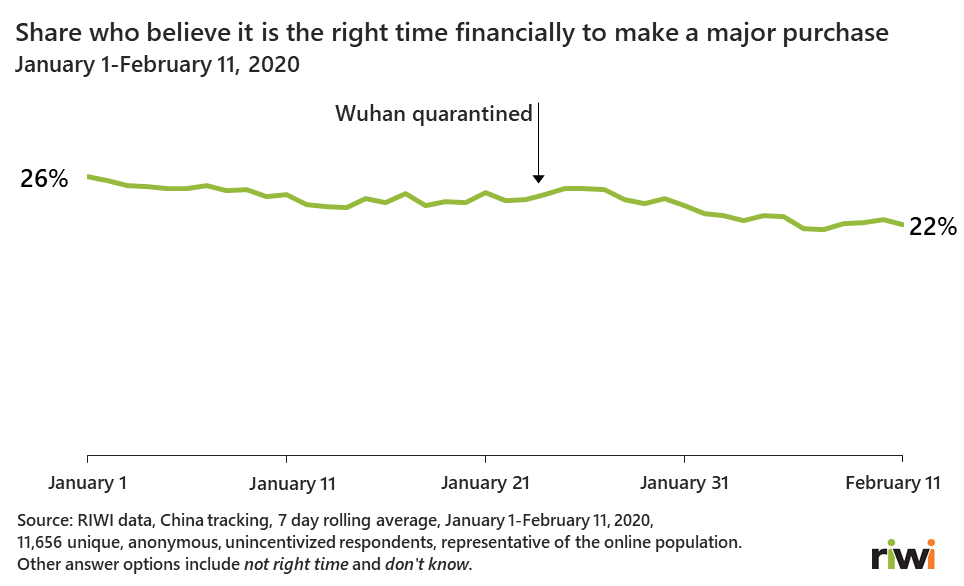

- RIWI daily consumer confidence data in the People’s Republic of China show a slight deterioration in consumer confidence from when the outbreak became public until February 11, but this is not out of line with the confidence levels in RIWI China data collected daily during 2019. The current consumer confidence level in Hubei province (where Wuhan is located) is much lower than the national level, by contrast.

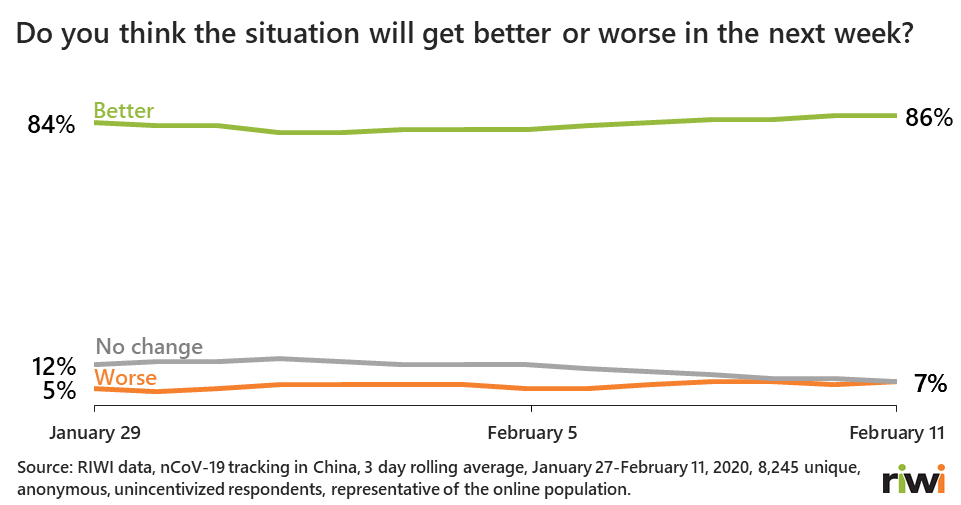

- RIWI’s daily data from January 24-February 11, 2020 also show strong and consistent confidence among the Chinese people that the outbreak situation will get better and is being handled well. In the week ending February 9, 83 percent self report that the situation will get better next week.1

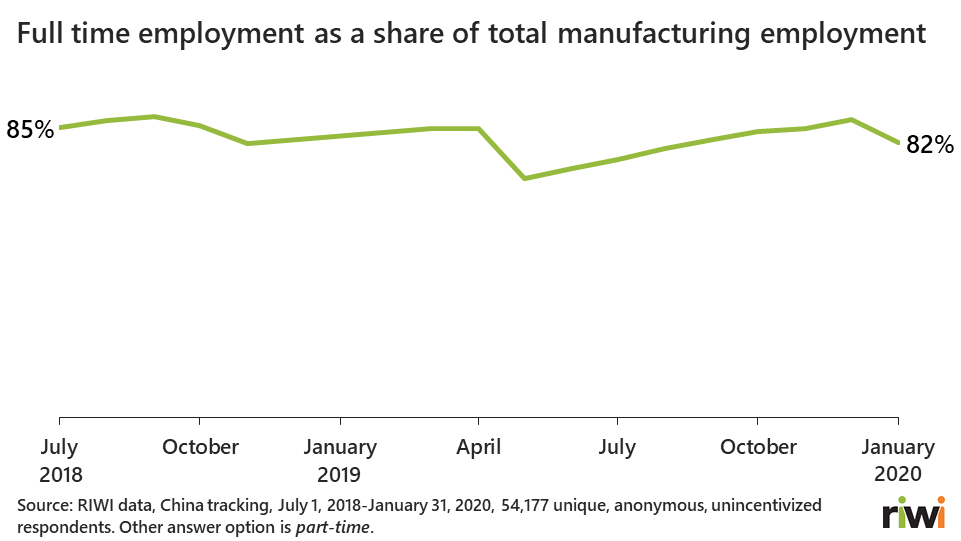

- RIWI’s continuous employment data confirm the improvement in economic conditions as reported in official data in late 2019, and show slight decline in January 2020 from the month prior, beginning before the outbreak became public.

- Now that the extended Lunar New Year break is officially over, the continued daily collection of both employment and wage series data will allow RIWI to monitor the size of any deterioration in full-time employment or wages, any rise in involuntary part-time employment, or declines in manufacturing workers relative to other sectors, in advance of the release of official economic data.

Monitoring the economic impact of the outbreak in real-time

China has undergone a dramatic shock with the 2019-nCoV outbreak. Economists agree the outbreak will have a negative impact on China’s economy. What is not clear is how deep that impact will be, how widespread, and how long-lasting. Estimates of the impact so far range considerably from 6 percent of GDP to 0.1 percent in Q1 2020.2 What is also unclear is whether official data accurately captures the extent of the negative impact. The size of the economic impact of the outbreak on China matters to the global economy, given the extent of travel, trade, and supply chain connectivity between China and the rest of the world.

RIWI has been gathering high-frequency data in China on a range of economic indicators since the start of the trade war in June 2018, allowing us to monitor certain aspects of the economic impact of the outbreak now in real-time before official and other data become available, to provide an alternative gauge as a check on official data, and to provide alternative indicators not otherwise available such as employment changes by sector of the Chinese economy.

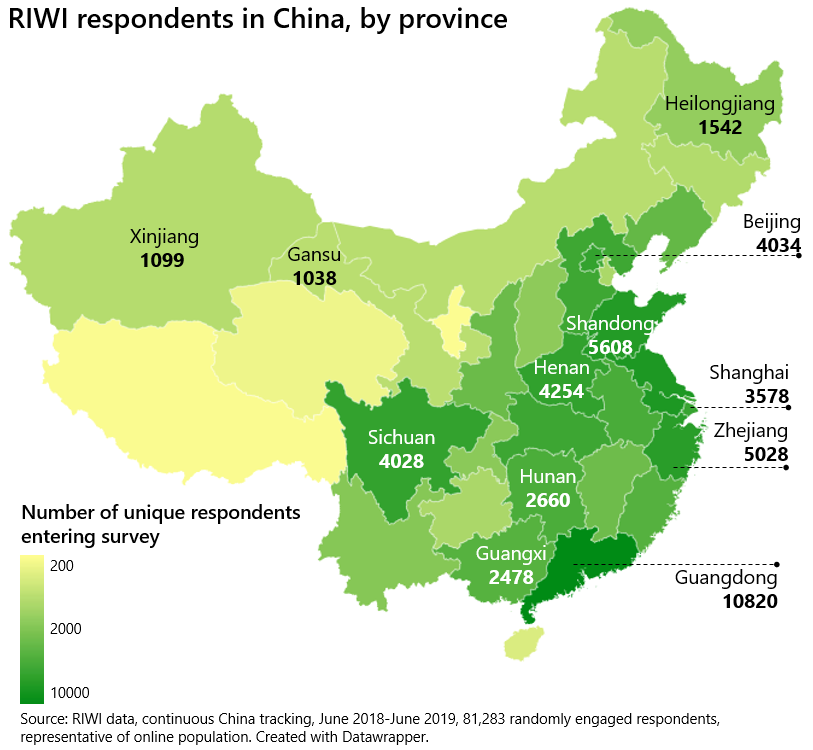

RIWI technology works such that anyone online in China on any device at any time of the day has an equal chance of being randomly exposed to RIWI questions. This allows RIWI to gauge broad-based sentiment among the world’s largest online population, and beyond typical surveys or “walled gardens” of social media. Unlike in typical surveys, the vast majority of RIWI respondents in China have never answered a survey before. All data are gathered anonymously, and available nationally and in every region, including in Hubei province, the regional heart of the outbreak.

In addition to continuous tracking throughout all of China, starting on February 5, we launched an additional separate study that focused on Hubei province, including the city of Wuhan, the epicentre of the outbreak, to enable us to assess going forward whether the impact on the rest of the country is as severe as that seen in Hubei.

Confidence is only slightly down from trade war period

So far, RIWI January and February 2020 daily consumer confidence data show a slight decrease in the share of respondents who believe it is the right time financially to make a major purchase. However, this deterioration in consumer confidence following the quarantine of Wuhan is still within the consumer confidence levels that we saw in 2019 (see chart below).

In Hubei province, 44 percent of respondents currently believe it is not the right time financially to make a major purchase, compared to RIWI’s 2019 average of 35 percent nationally and 36 percent in Hubei.

Confidence doesn’t necessarily translate into actual spending when one’s ability to act on that confidence is limited; citizens are not fully back to work or engaged in regular consumer activities. Still, the data reveal the degree to which citizens feel confident about their economic circumstances and provide an indication of how long it will take for any post-outbreak bounce back. We will continue to monitor this in our daily data to see if there is a sharp deterioration.

Strong self-reported public confidence that the outbreak situation will get better

Some Western media are calling attention to public anger toward the Chinese government’s handling of the outbreak – often citing as evidence for this anger viral posts circulating on social media (this was particularly the case in the wake of the death of Dr. Li Wenliang from the virus, who had been detained by the authorities in December for what they said was spreading rumors about the virus but proved to be correct).

Yet RIWI data show that this is not the dominant sentiment among the broad-based online population. On February 11, 86 percent of respondents believed the situation would in fact improve the next week, consistent with or improved from sentiment extracted from responses gathered by RIWI over the previous week. RIWI’s daily data from January 24-31 also show strong and consistent confidence among the Chinese people that the outbreak situation is being handled well.

Slight deterioration in manufacturing employment before outbreak became public

RIWI’s ongoing manufacturing employment data confirm the improvement in economic conditions seen in official data in late 2019, and show a small decline in January from the month prior, beginning before the outbreak became public.

When will we see any impact trickle through to employment? How severe will it be?

Chinese workers were supposed to continue to receive their wages over the extended New Year holidays. As people return to work after the extended Lunar New Year break, the continued daily collection of both employment and wage series will allow RIWI to monitor the size of any deterioration in full-time employment or wages, any rise in involuntary part-time employment, or declines in manufacturing workers relative to other sectors. This will allow us to assess whether official data are reliable, whether the outbreak is confined to Hubei province or more widespread, and how quickly and deeply impacts are translating into the labor market as compared to the RIWI employment data before the outbreak.

To what degree will online work and consumption mitigate the economic impact?

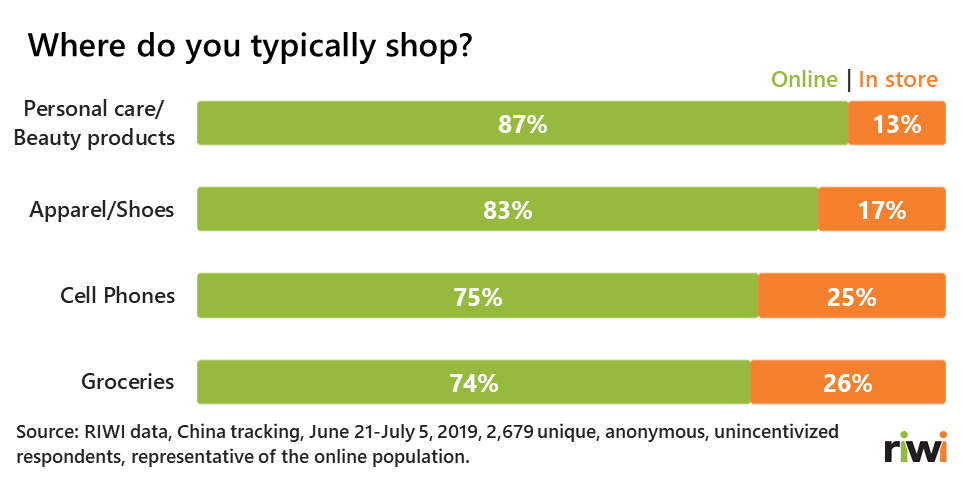

A key difference many point to between the SARS outbreak and the current situation is that so much of China’s consumer activity now takes place online rather than in person. This has the potential to reduce the negative economic impact of the outbreak if online activities can still take place during lockdowns or with increasing normalcy as work activity resumes.

RIWI data show that for every category, online shopping dominates among China’s Web-using population. RIWI’s global data on the adoption of online payments and online services such as online health care also show that China is the global outlier in the early and widespread adoption of such practices. Whether services can be purchased online matters even more now compared with during the 2002-2003 SARS outbreak because services today represent 54 percent of the Chinese economy (versus 42 percent during SARS).

RIWI data have also revealed that China is the global leader and by far an outlier in the adoption of online-facilitated platform work options such as food delivery apps, online freelance data entry, or tagging of faces for machine learning applications via online task work platforms. This could lessen the negative economic impact of the outbreak for those who can continue to do this type of work regardless of where they are, as long as they have Web access.

RIWI predicted Purchasing Managers’ Index (PMI) to show depth of impact

An independent assessment3 shows that RIWI employment and wage data as reported to RIWI by Web users across China are more predictive (0.87 correlation; Multiple R, p<.01) than existing benchmark data of a key monthly headline economic indicator in China: the manufacturing purchasing managers’ index (“PMI”). The PMI is a Chinese government survey of business conditions in the Chinese manufacturing sector that comes out ahead of official economic data. It is watched closely in financial markets as a good early signal of China’s economic performance and changes in the business cycle. It is correlated with industrial production and GDP.

Since all RIWI data are high-frequency data, collected in nearly real-time, it is also possible to examine these data on a daily basis, or for any time period prior to the end of the month, instead of waiting until the end of the month when the PMI becomes available. The analysis shows that, even by the 15th of each month, the RIWI model is still highly predictive (0.82 correlation; Student’s t-Test, p<.05) of the official headline PMI.

What will the RIWI predictive PMI show for February? How significant a deterioration will we see? RIWI will continue to monitor this to gain an advance indication of the true extent of the disruption, before the official PMI release.

RIWI is also monitoring and validating a range of official and other economic indicators across all regions of China using its high-frequency, broad-based sentiment data benchmarked against historical RIWI high-frequency data. This includes travel intentions within China and outside, consumer spending trends, sectoral employment changes, business sentiment and intentions to expand or shrink, smartphone purchase intent, and other customized indicators, at both the national and regional levels. We will continue to monitor these data to determine the depth, spread, and length of any deterioration and the speed with which currently constrained consumer and business activity will change in a positive direction.

The continuous data collection will also allow RIWI and our clients in the finance sector to determine how much of the deterioration in economic activity is due to the outbreak and how much is due to an underlying weakness or decline that began before the outbreak. These data-enabled insights will thereby tell us the degree to which different aspects of economic malaise or resilience are likely to persist after the outbreak can be effectively contained.

RIWI captures anonymous, broad-based sentiment from across all of China

Since June 2018, we have used RIWI technology to randomly engage 158,781 respondents from China’s Web-using population to answer questions about their economic behavior and attitudes. The resulting data are high frequency in nature, gathered 24/7 and on a continuous basis, allowing analysts to assess the true impact of the current outbreak. When the world learned about the outbreak, we added a new ongoing survey with a unique set of randomly engaged respondents, asking Chinese people about their level of confidence in public health officials. The RIWI data are broad-based, come from across all regions of China (rural and urban), and draw daily from non-habitual survey respondents. RIWI respondents are un-incentivized, meaning that they answer because the questions seem interesting; they do not benefit in any way by responding.

RIWI collects data using patented, machine-learning technology in order to reach the broadest possible set of potential survey respondents continuously, drawing in populations otherwise not included in data collection, especially in monitored information environments. Anyone using the Web in the country could be randomly exposed to a RIWI survey, resulting in the vast majority of RIWI’s Chinese respondents never or rarely taking prior surveys. This is unlike typical surveys in China that draw only on key urban centres and on habitual, incentivized survey respondents – or on content residing on censored social media. Unlike typical episodic non-random panel-based surveys, RIWI surveys are anonymous, continuous, random and do not collect personally identifiable information. These RIWI measures increase the likelihood that respondents will answer truthfully.

RIWI is a global trend-tracking and prediction company, and a leader in data quality, privacy, and security (see here for more information). RIWI technology is used extensively and under long-term agreements by BofA Securities, the U.S. State Department and by other G7 government agencies, the World Bank, UN agencies, and by academics at top Universities such as Harvard and Oxford. RIWI has won several awards for its global trend-tracking and predictive analytics technology, including the “Rising Star” award for its China data at the 2019 Battle of the Quants in New York City. Independent validation shows that RIWI data are highly predictive of headline US economic indicators such as non-farm payroll surprises.

To learn more about RIWI’s data tracking in China and all countries, please contact us at ask@riwi.com

- RIWI data from this series were featured on January 30 during the International SOS, Centers for Disease Control and Prevention, and APCO Worldwide webinar to Fortune Global 500 companies on how to protect their global workforce from the new coronavirus outbreak.

- Koldyk, Daniel. February 6, 2020. China Briefing: The Macroeconomic Environment Comes Under Strain. Economic and Financial Affairs Section, Canadian Embassy in Beijing.

- Mark Kruger. Assessment of RIWI’s China data, January 17, 2020. Please contact RIWI (inquiry@riwi.com) for a copy of this analysis or to learn more about it.